What is a CIBIL Score and how is it calculated?

If you have been borrowing for a while, you may have heard of CIBIL scores. The CIBIL score is typically just used as a reference point by most individuals, who rarely go into the specifics. Ever wonder how your CIBIL score is determined? Do you find yourself wanting to know more about the formulas used to determine your credit score?

It makes sense to inquire about these matters and keep yourself informed if you are a borrower. It may be useful if your report indicates a low credit score in the future while contesting your credit score and report. Let’s examine the specifics of CIBIL score calculation-

What is a CIBIL Score?

The range of a CIBIL credit score ranges from 300 to 900, with 300 denoting the lowest possible score and 900 denoting the greatest. According to this number, a person’s “creditworthiness” is represented. An individual with a higher CIBIL score has demonstrated strong credit history and responsible repayment conduct.

A person’s full credit history from at least the previous six months is used to determine their CIBIL score. This information, along with a number of other criteria, is used in an algorithm to determine the final CIBIL score.

Why is it Important to Have a Good CIBIL Score?

An excellent CIBIL score, or one that is between 700 and 900, is quite advantageous. Banks and other lending institutions assess this score when evaluating loan and credit card applications. As a result, it can increase their trust in granting your credit requests.

- You might also experience some other advantages, such as:

- lower loan interest rates

- increased credit limits

- Better terms for repayment, including a longer or more flexible payback period

- an expedited loan approval procedure

- more loan institutions to choose from

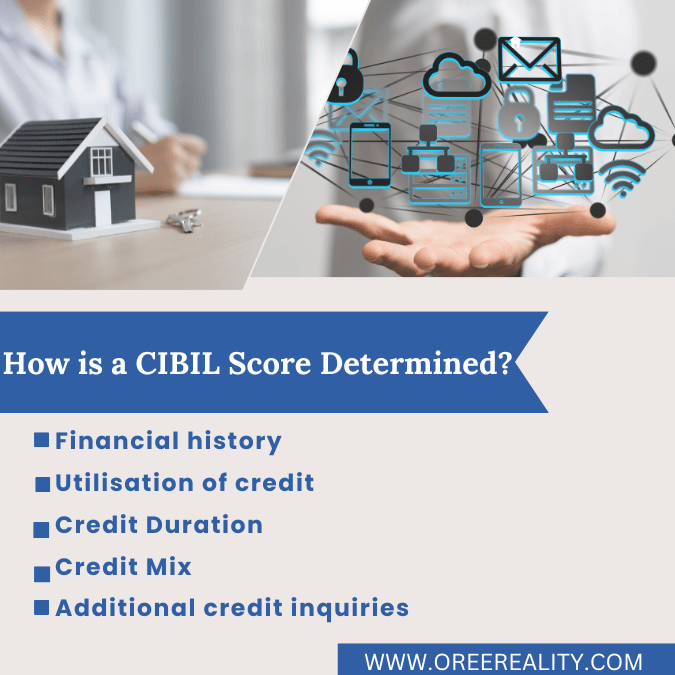

How is a CIBIL Score Determined?

As mentioned earlier, a person’s credit score ranges from 300 to 900, with 900 being the best score that can be achieved. Credit information bureaus utilise an algorithm to construct these ratings based on a variety of inputs. These consist of:

1. Financial History

Your history of on-time repayments is one of the key elements used to determine your credit score. This involves making loan and EMI payments as well as credit card payments. Each month, banks and other financial organisations report this data to credit bureaus.

Your credit score will drop if your credit report ever shows that you have ever skipped or delayed making payments on your bills and EMIs.

2. Utilisation of credit

The percentage of your credit that you use is referred to as credit utilisation. This should not exceed 30% of your total credit limit. If your credit limit is $100,000 per month, for instance, you ought to attempt not to use more than $30,000.

Maintaining a low credit utilisation rate will assist in lowering your credit score. You can achieve this by making regular transactions with a debit card or cash, increasing your credit limit, or getting a second card.

3. Credit Duration

Your credit history’s duration is a crucial consideration. It basically comes down to how long you’ve had a credit account, as older accounts and credit cards can reassure lenders that you’ve been paying your payments on time over the course of a long period of time.

The length of time it has taken you to service your credit is a significant component in calculating your credit score. For instance, choosing to repay your loan over a longer period of time rather than taking out a short-term loan will help to raise your credit score. You should also make prompt and timely payments on this loan.

4. Credit Mix

Your credit score might be affected by the type of credit you have chosen, among other things. Unsecured loans and secured loans are the two primary categories of loans. Credit cards and personal loans are examples of unsecured loans, whereas auto loans and mortgages are examples of secured loans.

Lenders may see having a higher proportion of unsecured loans negatively in general. It could affect your score because you can be considered a dangerous borrower. On the other hand, lenders and credit reporting agencies favor secured loans, which might raise your credit score. Consequently, it is advised to choose a balanced combination of unsecured and secured loans.

5. Additional credit inquiries

The quantity of credit applications you have made is one last element that can have an impact on your credit score. These cover requesting loans, credit cards, etc. Every time you apply for new credit, the bank or lending organization will do a “hard inquiry” of your credit report to find out more about your credit history.

Your credit score may be impacted by these difficult inquiries. Therefore, it is wise to only submit applications to institutions that are likely to approve them.

Conclusion

When you are aware of all of these issues and how they may affect your credit score, you can prevent a low CIBIL score. This is potentially quite essential at the time of a loan application. To ensure that your score is high, regularly check your credit score and credit profile.